“The stock market is the only place where things go on sale, yet everyone runs out of the store screaming.” -Old stock market axiom

Here are four things that have caught my attention over the past week.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

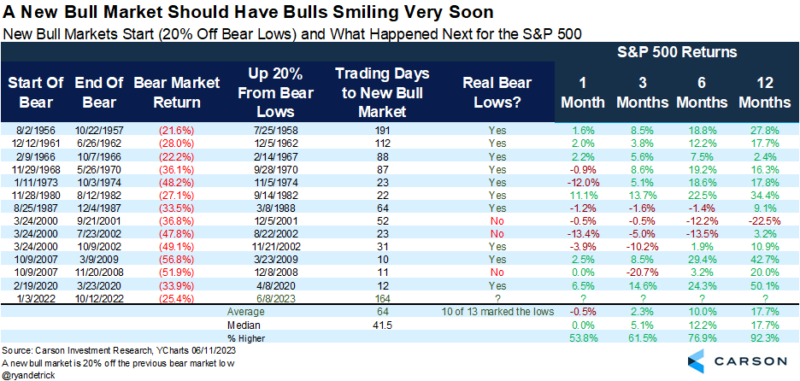

First up, you might have heard by now, but the S&P 500 moved into a new bull market, up more than 20% from the October ’22 lows. We wrote about this in detail here, but investors need to know that a year after this happened, the S&P 500 was historically up 17.7% on average and higher 12 out of 13 times.

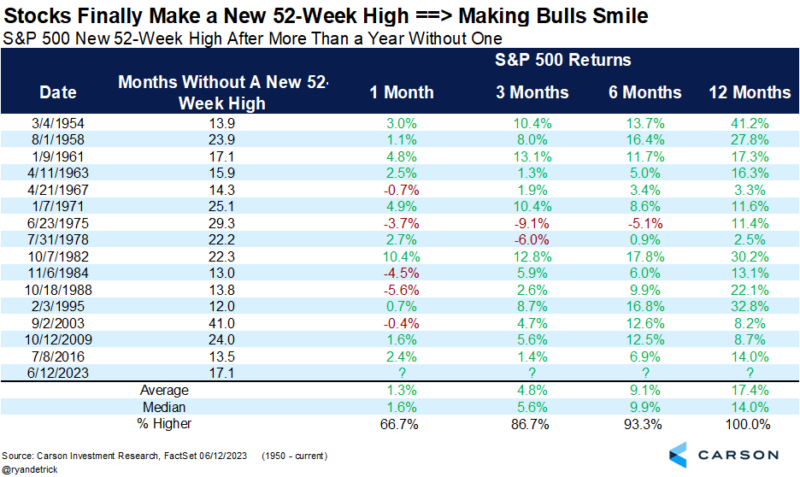

Adding to the fun, S&P 500 finally made a new 52-week high this week, the first one since early January 2022. What does this mean? Below we looked at all the times stocks went at least one year without a new 52-week high and the good news is more strength is quite likely. A year later stocks have been higher an incredible 15 out of 15 times and up more than 17% on average. Adding that to the numbers in the first table and the next year could continue to surprise to the upside.

Next up, this week marked officially eight months since the bear market ended. To think stocks would be up more than 20% by now would have been crazy to most investors if they were being honest. The quote I used above is one I always think about when stocks fall and it really does sum up investor sentiment well. Very few were saying ‘buy stocks’ last October and most didn’t say it early in 2023 either.

We did note the week of the lows why the lows were likely in (and boy did the bears hate that call), but even I’ve got to admit the strength this year has been impressive. We moved to overweight equities in our Carson House View models in mid-December and we added to equity risk in late March during the regional bank crisis. To sum it up, we’ve been in the lonely bullish camp and continue to think higher prices are coming.

What does eight months without a new 52-week low mean? It would be extremely rare for stocks to roll over and make new lows from here for starters. Also, three months later the S&P 500 was up 85% of the time, six months later 90% of the time, and a year later 80% of the time higher. The bottom line, once you get to eight months without a new 52-week low, the upward trajectory likely stays in place.

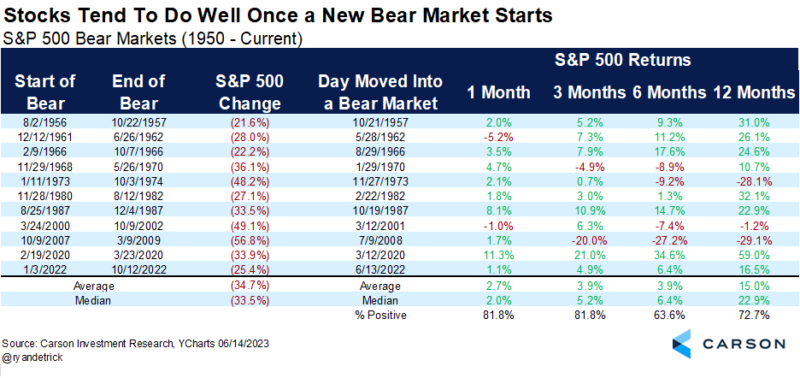

Lastly, the bear market officially started a year ago this week, as the S&P 500 moved to down 20% from the January ’22 peak on 6/13/2022. That wasn’t a fun time for investors at all, but here we are a year later, and stocks are up more than 16%. In other words, had you had the intestinal fortitude to buy when all the headlines were negative, you’d be sitting on some great gains a year later. Again, think about the quote at the top of this blog. This is what is important to always remember. Stocks go up and they go down. If you want to get some good deals, you need to buy when they are lower.

Thanks for reading and have a great weekend!