One of the most hated and despised rallies continued last week, with the S&P now up nearly 12% on the year and officially up more than 20% from the October lows. If you’ve been reading or listening to what the Carson Investment Research team has been saying, then you know we’ve been in the camp we’ve been in a new bull market for quite some time now, expecting continued higher prices. None the less, with stocks now officially up 20%, we see others finally coming around. For instance, check out the cover of Barron’s over the weekend. Yeah, we sure weren’t seeing things like that in January, were we?

Sonu and I both wrote blogs last week on stocks being up 20% from the lows and you can read them here and here. Additionally, here’s a Yahoo! Finance hit I did on October 13, the exact day that stocks officially bottomed. I noted many reasons to think better times were coming and fortunately, that is exactly what has happened.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Additionally, here’s the blog I wrote a week after the October lows titled Why Stocks Likely Just Bottomed. Our bullish tilt since late last year wasn’t popular and has been widely mocked by many bears for months and months. We aren’t hearing so much chirping from them now though 🙂

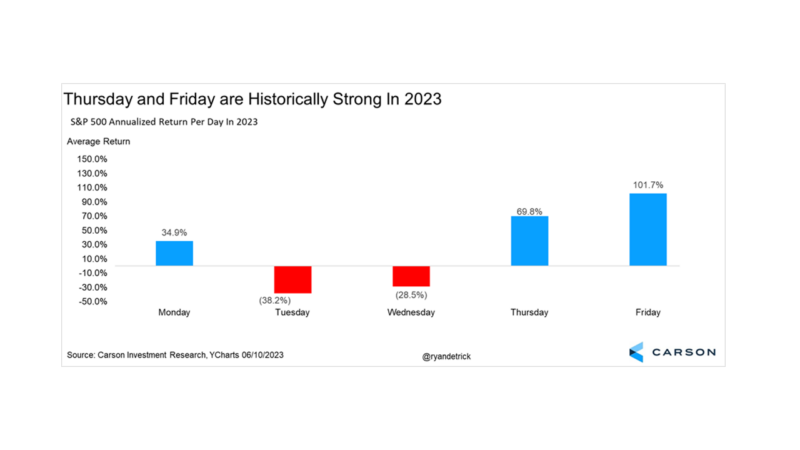

One thing we’ve notice lately is buying and strength in stocks later in the week, specifically on Thursday and Friday. We love to see this, as it shows there is confidence to hold stocks over the weekend. Those of us that have done this long enough remember how volatile (and usually bearish) Friday afternoons would be during the Great Financial Crisis (GFC) or during the COVID bear market in February and March of 2020. Even last year during the bear market we saw historically weak returns on Friday.

So, to now see buying and confidence on Thursday and Friday in ’23 are significant changes from what we saw during previous bearish phases and could be another clue that this bull market is indeed healthy and likely has legs left.

This first chart shows just how much better Thursday and Friday are doing than the other days this year. Again, we like to see this late week buying as a clue things are healthy and confident. (For those wondering how we did the annualized return calculations, the average Friday return this year so far has been a gain of 0.40%, so we multiplied that by 252 (the number of trading days per year) to get an annualized return).

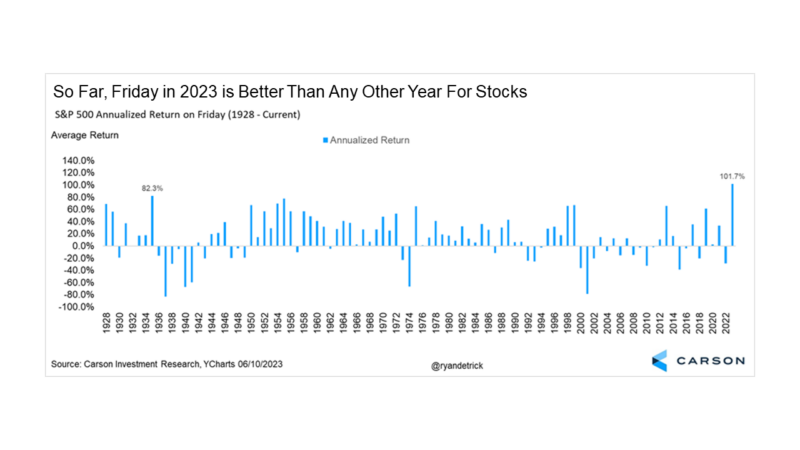

Let’s talk specifically about Friday, shall we? As of last week, Friday was up an incredible 101.7% on an annualized basis in ’23. This would come in as the best Friday EVER. Now, let’s be honest, the odds do favor this coming back to earth some over the remaining rest of the year, but overall we are on a great start to this year being one of the best ever for stocks on a Friday.

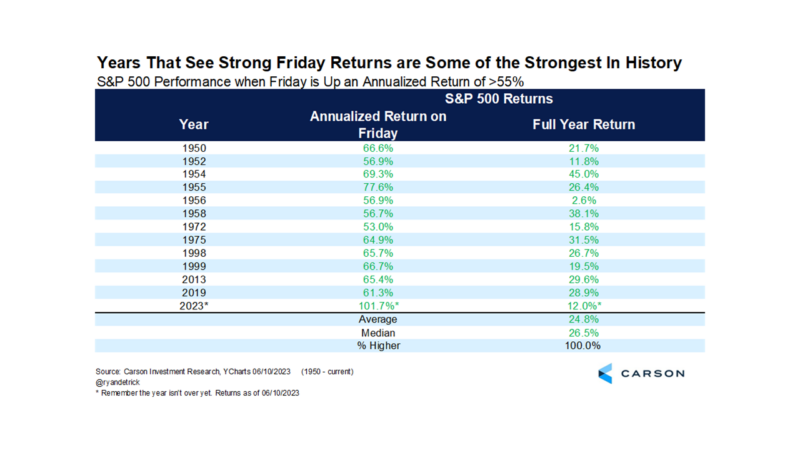

What does it all mean you ask? In the final table below, I looked at all years that had at least a 55% annualized return on Friday. This was the very best 12 years ever for Friday returns and sure enough, they are also some of the best years overall for stocks. In other words, some of the best years ever also saw strong performance on the last day of the week, further confirming that buying on a Friday is what you tend to see in bullish markets.

We will end on this note, stocks were higher 12 out of 12 times in these years and up a very impressive 24.8% on average, about half of this year’s 12.0% return so far. This could be a subtle clue that as good as this year has been, it could have more in the tank before all is said and done. I did discuss this Friday concept on Yahoo! Finance on Friday.

Lastly, I’m honored to join YCharts for a webinar this Thursday, as I’ll discuss Debunking Sell in May and so much more. It should be a fun hour and I’d be honored if you could just us. Sign up here!