About

Almanac Trader

I am the editor of the Stock Trader's Almanac & Almanac Investor Newsletter. I use historical patterns and market seasonality in conjunction with fundamental and technical analysis...

+ FOLLOW THIS TUMBLRAugust Can Be Challenging in Pre-Election Years

Money flows from harvesting made August a great stock market month in the first half of the Twentieth Century. It was the best DJIA month from 1901 to 1951. Now it is the worst DJIA and second worst S&P 500, NASDAQ, Russell 1000, and Russell 2000 month over the last 35 years, 1988-2022 with average performance ranging from 0.1% by NASDAQ to a –0.9% loss by DJIA. Last year, DJIA, S&P 500, NASDAQ, and Russell 1000 all declined over 4% in August.

Contributing to this poor performance since 1988; the second shortest bear market in history (45 days) caused by turmoil in Russia, the Asian currency crisis and the Long-Term Capital Management hedge fund debacle ending August 31, 1998, with the DJIA shedding 6.4% that day. DJIA dropped 1344.22 points for the month, off 15.1%—which is the second worst monthly percentage DJIA loss since 1950. Saddam Hussein triggered a 10.0% slide in August 1990. The best DJIA gains occurred in 1982 (11.5%) and 1984 (9.8%) as bear markets ended. Sizeable losses in 2010, 2011, 2013, 2015 and 2022 of over 4% by DJIA have widened its August average decline.

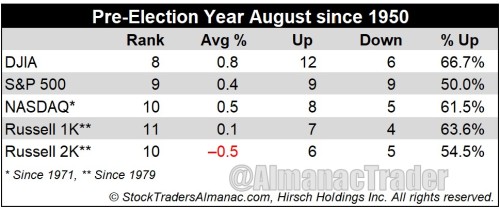

In pre-election years since 1950, Augusts’ rankings improve modestly: #8 DJIA, #9 S&P 500, #10 NASDAQ (since 1971), #11 Russell 1000 and #10 Russell 2000 (since 1979). Average performance in pre-election years is positive except for Russell 2000. However, all five indexes have declined in August during the last three pre-election years, 2019, 2015 and 2011. It would appear, August’s pre-election year advantage is fading.