About

Almanac Trader

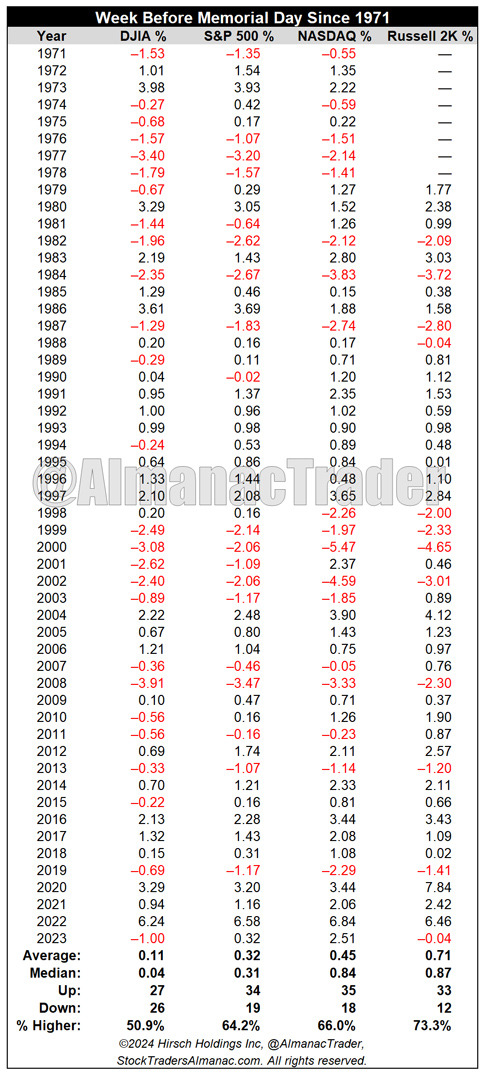

I am the editor of the Stock Trader's Almanac & Almanac Investor Newsletter. I use historical patterns and market seasonality in conjunction with fundamental and technical analysis...

+ FOLLOW THIS TUMBLR wmproprt reblogged this from jeffhirsch

wmproprt reblogged this from jeffhirsch  wmproprt liked this

wmproprt liked this  wiseunknownpost liked this

wiseunknownpost liked this curitibacitybrazil liked this

byronnight2 liked this

jeffhirsch posted this

jeffhirsch posted this