In 2016, more than 20 years after Amazon’s founding and 10 years since Shopify launched, it would have been easy to assume e-commerce penetration (the percentage of total retail spend where the goods were bought and sold online) would be over 50%.

But what we found was shocking: The U.S. was only approximately 8% penetrated — only 8% for arguably the most advanced economy in the world!

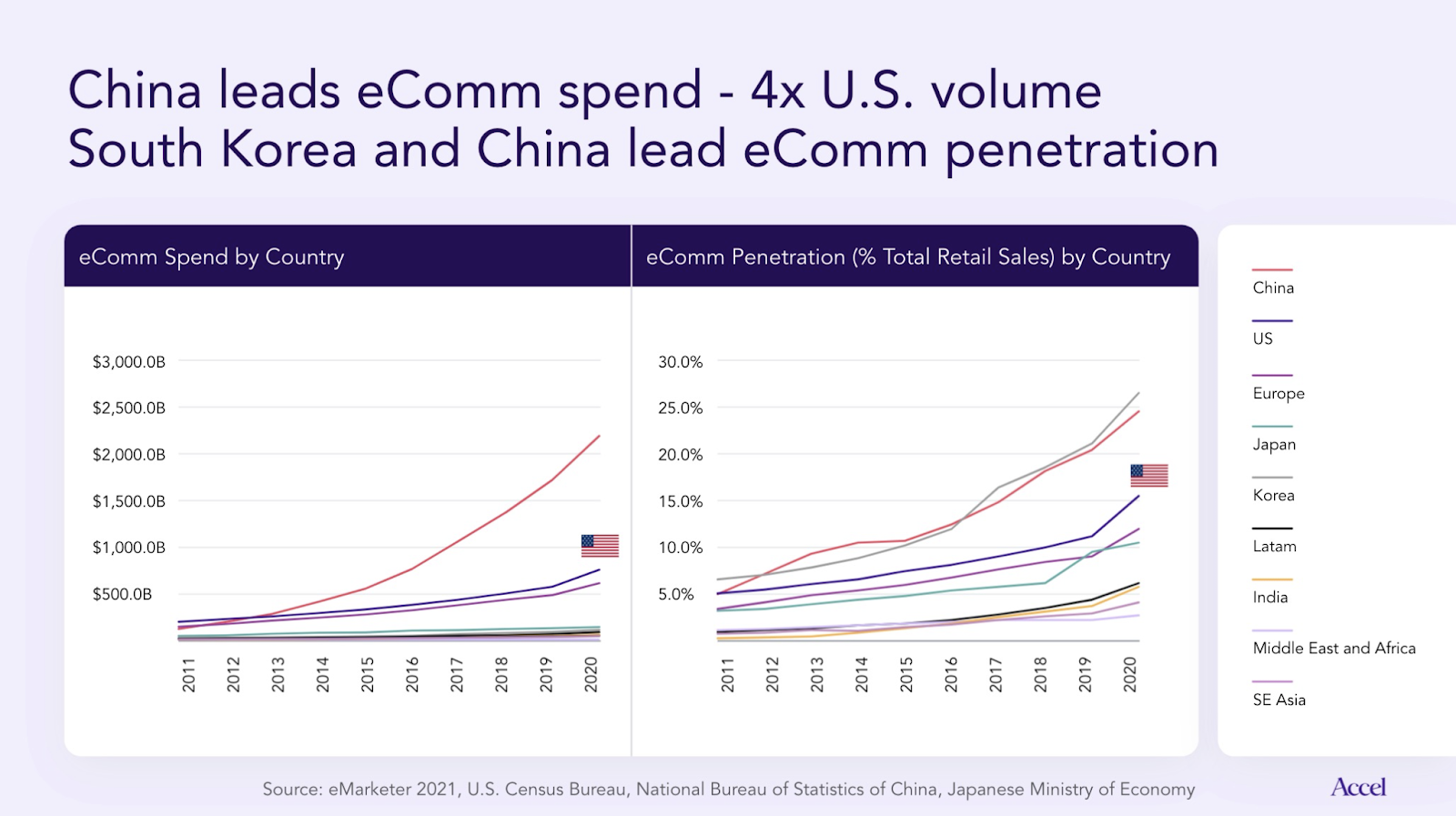

We’ve had a close eye on the rate of e-commerce penetration globally ever since. Despite e-commerce growth skyrocketing over the past year, the reality is the U.S. has still only reached an e-commerce penetration rate of around 17%. During the last 18 months, we’ve closed the gap to South Korea and China’s e-commerce penetration of more than 25%, but there is still much progress to be made.

Image Credits: Accel

It’s clear that we are still in the early days of this megatrend and it is our strong conviction that it is inevitable that we will get to a point where at least half of every retail dollar is spent online over the next decade.

Below are five key predictions for what this road to further penetration will hold.

D2C retail will accelerate as merchants seek independence

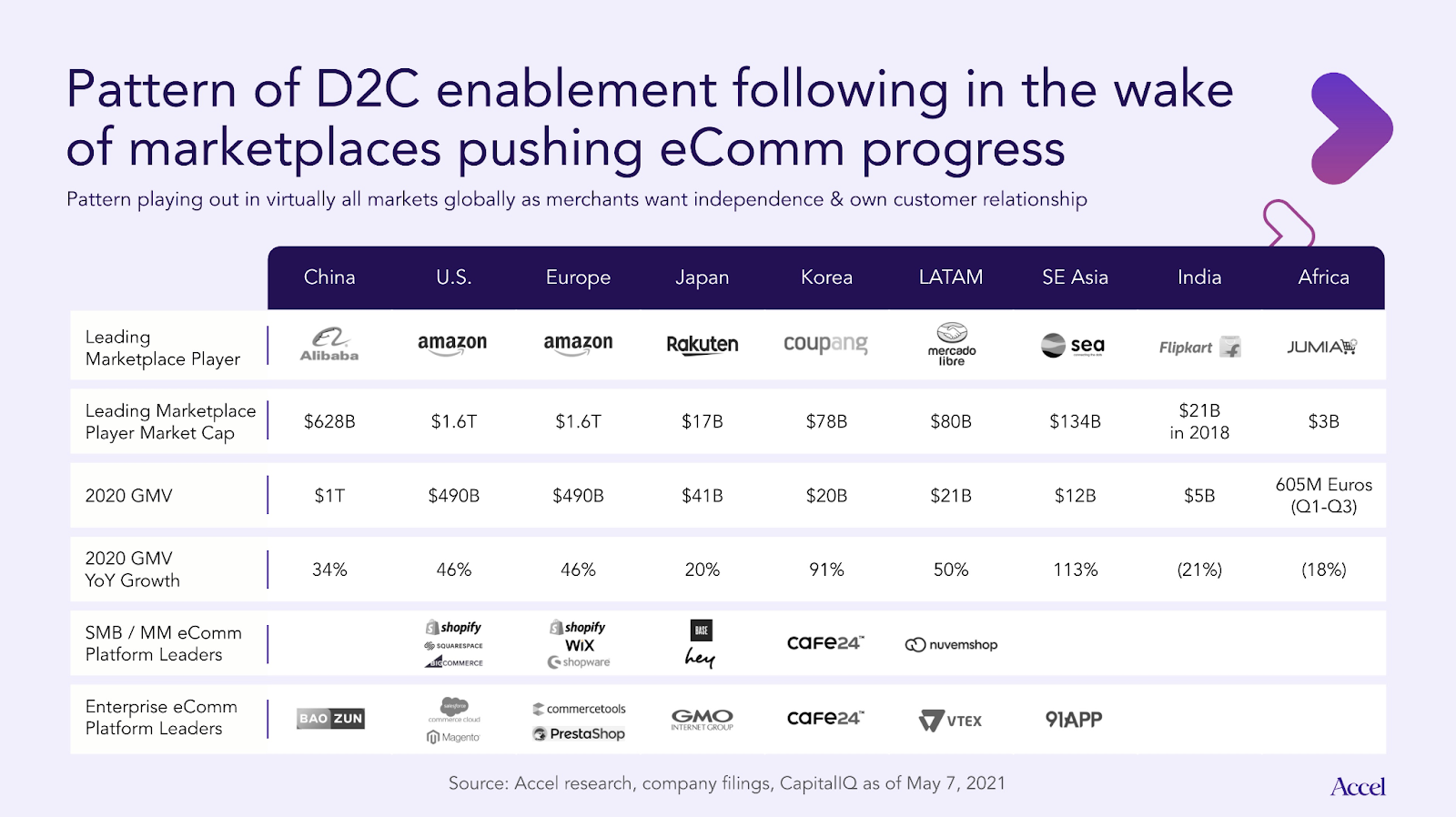

Marketplaces have forged the path for e-commerce adoption among merchants of all sizes. They have raised significant capital and made the necessary investments in payments and logistics infrastructure, often subsidizing the consumer experience with free shipping or discounts to get them comfortable buying online.

The balance of power has shifted toward merchants, who previously didn’t have the picks and shovels to build their own e-commerce capabilities.

In recent years, merchants have pursued options aside from these marketplace aggregators. They have sought independence, opting to pay 5%-10% of their gross merchandise value (GMV) on their own technology infrastructure rather than paying the 6% to 45% (average of about 15%) in marketplace fees. Most importantly, they have prioritized owning the relationship with their end customers, given that customer loyalty and lifetime value is becoming ever more important in a hypercompetitive online market.

Image Credits: Accel

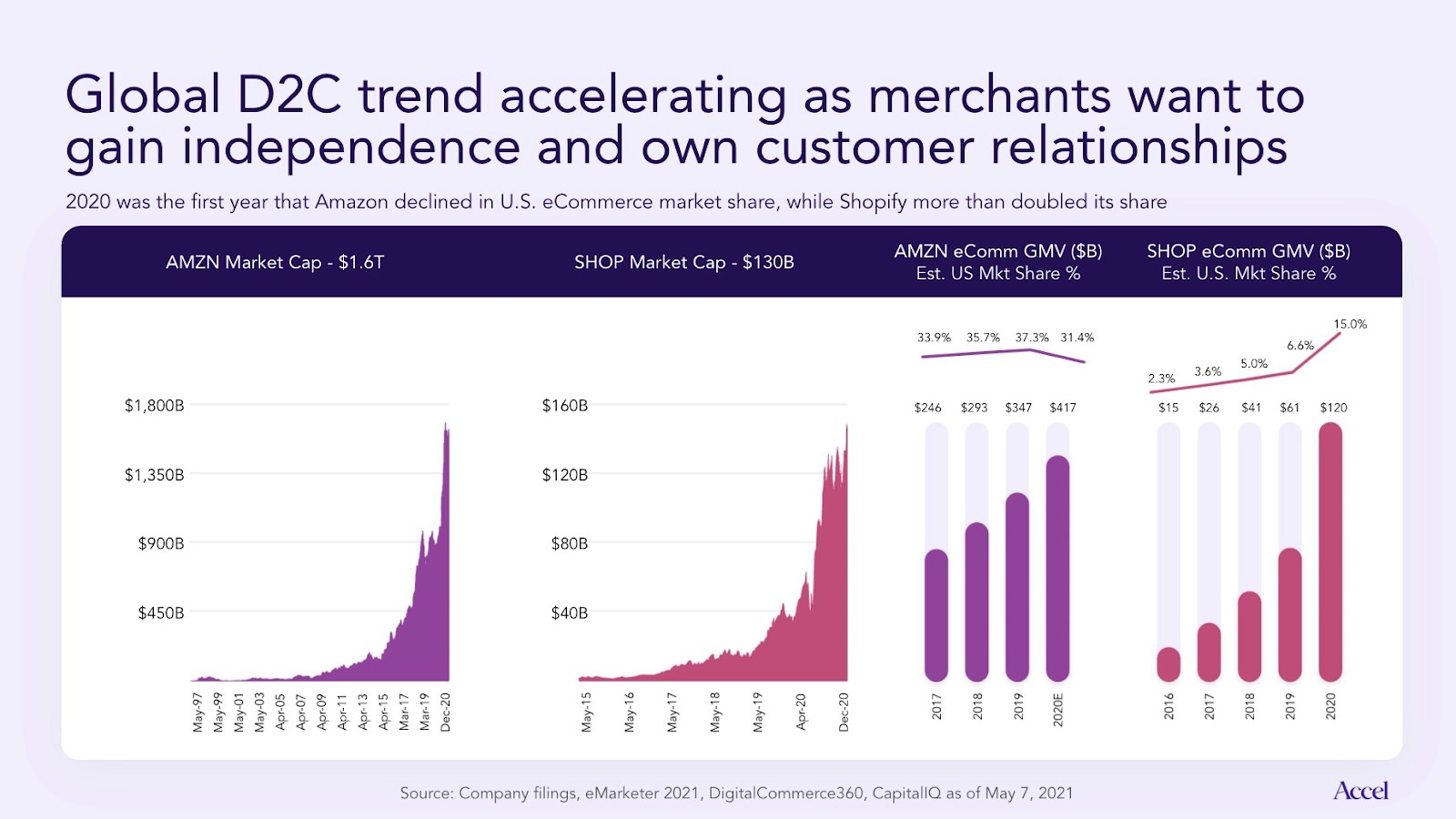

To understand these changes, look at the battle between Amazon and Shopify. Their market caps are awe-inspiring, with both almost quadrupling their valuations during the pandemic year. However, Amazon has other business lines like AWS, so you have to look at Amazon and Shopify GMV figures to see that, for the first time ever in its history, Amazon lost market share of U.S. e-commerce, while Shopify more than doubled in its share in 2020.

Image Credits: Accel

After more than 20 years of Amazon’s dominance in the U.S., Shopify democratized the e-commerce infrastructure that was once expensive and extremely difficult to build and implement. To be clear, we believe Amazon will continue to be a dominant player in U.S. e-commerce, but it has clearly recognized that the demand for D2C could have a massive impact on its business. The balance of power has shifted toward merchants, who previously didn’t have the picks and shovels to build their own e-commerce capabilities.

As a result, we’re entering what we at Accel believe is “the golden age of D2C e-commerce.”

The SMB and midmarket will continue to be the fastest-growing segments and D2C e-commerce platforms will play key roles in continued growth

The surge in e-commerce growth today is driven by the SMB and midmarket, not the enterprise, and platforms like Shopify, BigCommerce and Nuvemshop have changed the game for merchants by democratizing e-commerce infrastructure and empowering merchants everywhere to go D2C and own their own destinies.

E-commerce infrastructure was historically focused on enterprises that could afford expensive and complicated software. Products such as IBM Websphere, Oracle ATG, SAP Hybris, Salesforce Demandware and Adobe Magento were simply out of reach for most merchants. They took many months — in some cases years — to implement and required a lot of configuration and customization.

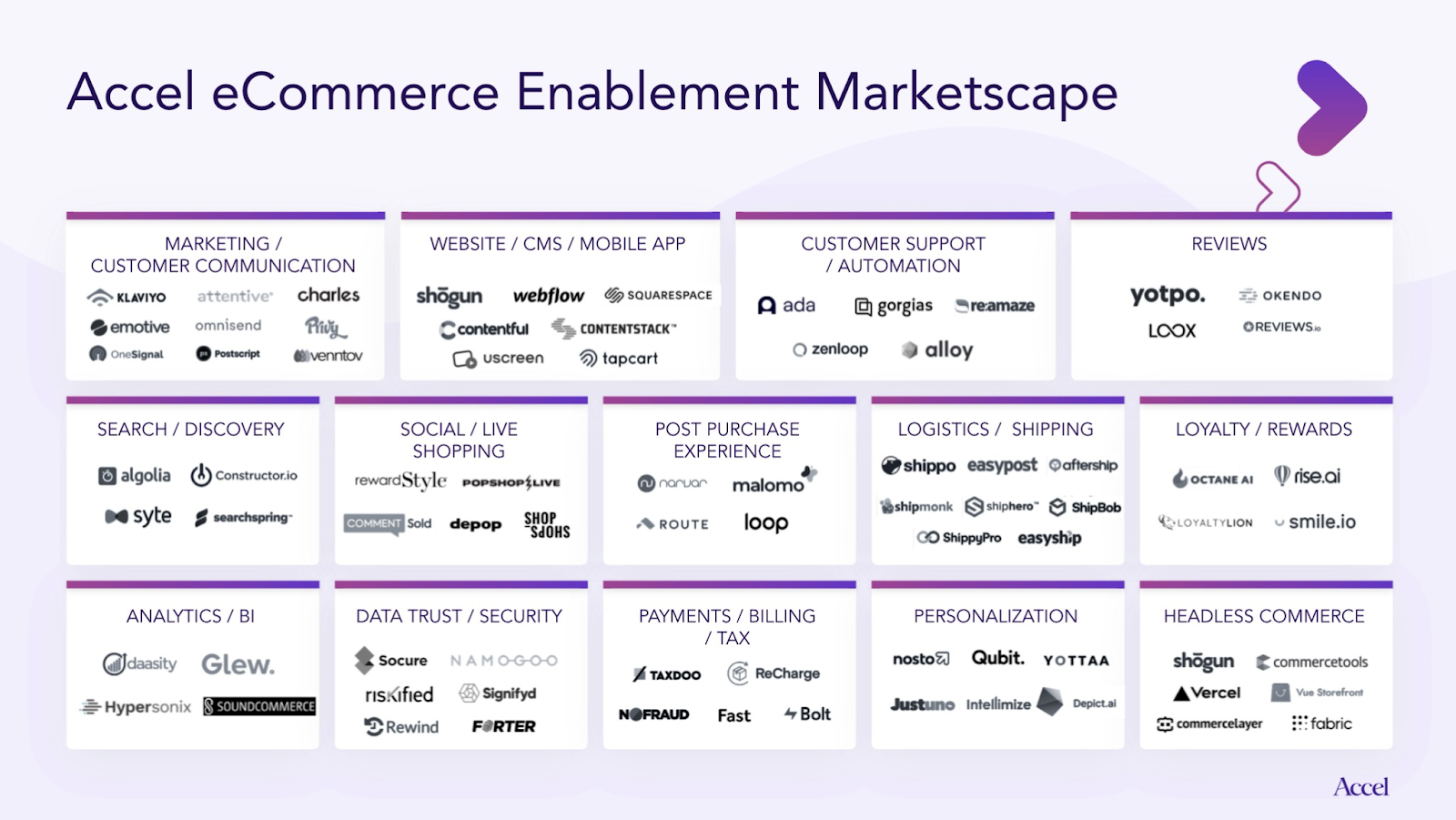

Image Credits: Accel

SMB and midmarket platforms are much simpler to use, relatively cost-effective, and enable merchants to get up and running in hours. They’ve also taken an “it takes a village” ecosystem approach, with app partners such as Alloy, Algolia, Klaviyo, Malomo, Octane.ai, ReCharge, Shogun and others catering to more sophisticated needs. We should see many merchants on custom tech stacks moving toward these platforms, and we fully expect Shopify’s to grow its merchant count to 5 million in the next few years.

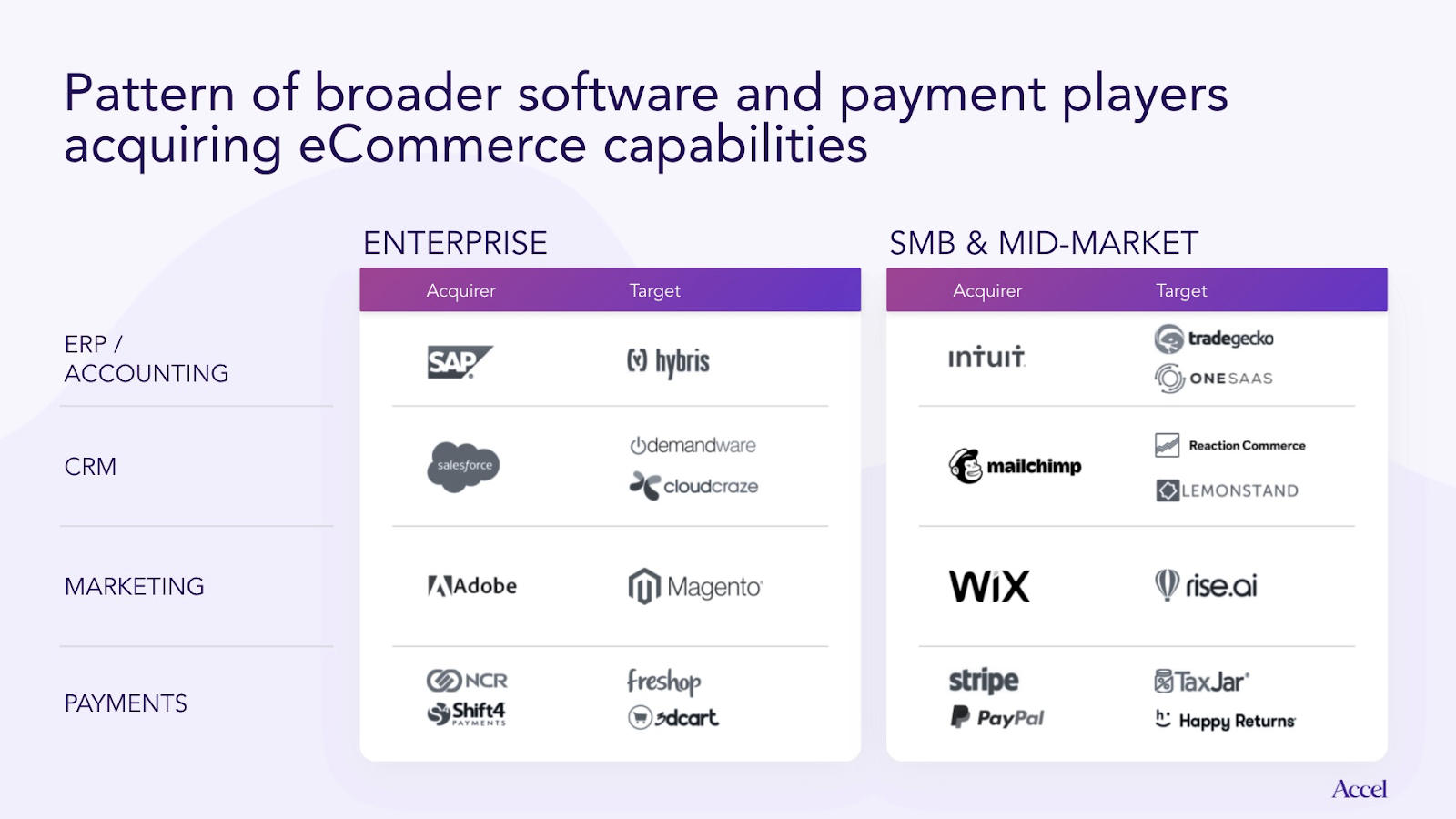

Outside players will increasingly look to acquire D2C capabilities to compete with e-commerce platforms

Over the past decade, we saw large enterprise software companies acquire e-commerce capabilities. SAP acquired Hybris, Salesforce acquired Demandware and Cloudcraze, Adobe acquired Magento. We’re now seeing SMB and midmarket players like Intuit and PayPal similarly acquire e-commerce capabilities as they seek to give their own customers an e-commerce back end. There will be much more of this M&A activity, and it will increase D2C options for merchants.

Image Credits: Accel

Data privacy changes will create even stronger D2C tailwinds

This point deserves its own op-ed, but, in short, Google Chrome third-party cookie changes and Apple’s app tracking changes will drive even stronger tailwinds for D2C. As brands and advertisers no longer have third-party cookies to track user behavior across websites and apps, their ability to target and retarget users across websites will increasingly be limited. Brands and merchants will be forced to establish first-party, direct relationships with their customers by gathering email addresses and phone numbers so they can communicate and market directly to them.

Social media platforms and publishers will increasingly move toward commerce-driven revenue models

As another byproduct of the cookie and app-tracking changes, social media platforms and publishers will move toward in-content commerce-driven revenue models as affiliate and third-party advertising becomes more challenging. China’s highly integrated social media and e-commerce experience is a model for the future of what shopping looks like on Facebook, Instagram, TikTok, Snapchat, Pinterest and other platforms. We expect product discovery and checkout to happen increasingly inside of these platforms, with some analysts predicting, for example, that Facebook will generate $200 million-$300 million in e-commerce revenue from its Shops product in Q3 this year.

Publishers like BuzzFeed have already started selling products within their articles, realizing that selling direct to consumer yields more revenue, as brands are willing to share a cut of sales rather than trying to prove attribution for lower CPC or CPM affiliate-based advertising revenue.

The path to 50% penetration

The U.S. increased e-commerce penetration in the last decade from 5% to almost 17%. Almost half of that increase happened in just the last year. While we don’t expect the same level of annual increase going forward, shopping behavior has fundamentally changed and, just as importantly, the way merchants want to sell their products has shifted from marketplaces to D2C. This D2C wave is a critical enabler for the progress we expect to see over the next decade as we strive toward inevitable 50% penetration. We are excited to witness this progress and the accompanying rise of incredible companies built to empower merchants all over the globe.